Preparing for Sale or Investment

Make Your Business More Investable or Saleable

When seeking external investment or preparing for acquisition, you will face intense due diligence scrutiny. Investors and buyers aren't impressed by sales folklore, they want evidence.

The hard truth: A business that relies on the founder's relationships or a star salesperson gets heavily discounted. A business with systematic, predictable sales gets a premium valuation.

Dunrod helps you build the sales infrastructure that investors demand and buyers pay for.

The Due Diligence Reality

Whether you're raising funding or preparing for exit, sophisticated investors and buyers will dig deep into your commercial operation, scrutinising:

- Revenue predictability: Can you accurately forecast the next 12 months? Where is the evidence to prove it?

- Customer acquisition economics: What does it cost to acquire and retain a customer? What us the Life Tim Value?

- Sales process documentation: Is there a demonstrable, repeatable system or does it depend on key individuals?

- Pipeline quality: Is your pipeline real or wishful thinking?

- Team capability: Can the sales team perform without the founders or commercial leaders?

- Scalability: Can you grow without proportionally increasing headcount?

If you can't answer these questions with data, you have a problem. Buyers and investors will become concerned about the future prospects of the business

Valuation Killers

Investors and buyers can identify red flags during due diligence processes:

- Single person dependency: Revenue drops when the CEO or sales lead goes on holiday

- Black box sales: No documented process

- Poor CRM discipline: Missing data, inaccurate pipeline, no forecasting rigour

- Inconsistent performance: One or two top performers, everyone else struggles

- Unpredictable revenue: Wide swings month to month / quarter to quarter

These red flags are seen as risks by investors and buyers. It is common for them to reduced business valuation by 20-30% in these circumstances.

Valuation Enhancers

Conversely, they will also identify green flags that will work in your favour:

- Systematic sales process: Documented, repeatable, teachable, scalable

- Data-driven forecasting: 90%+ accuracy over multiple quarters

- Transparent metrics: Customer Acquisition Costs (CAC), Life Time Value (LTV) , conversion rates, pipeline velocity, time to revenue should all be tracked

- CRM discipline: Fully embedded processes producing clean, accurate data that produces accurate forecasts

- Low founder dependency: Business operates smoothly with or without you

- Proven playbooks: New hires can follow documented processes and succeed

The green flags inspire confidence, maintaining or beating your valuation expectations and closing the investment or sale transaction quicker.

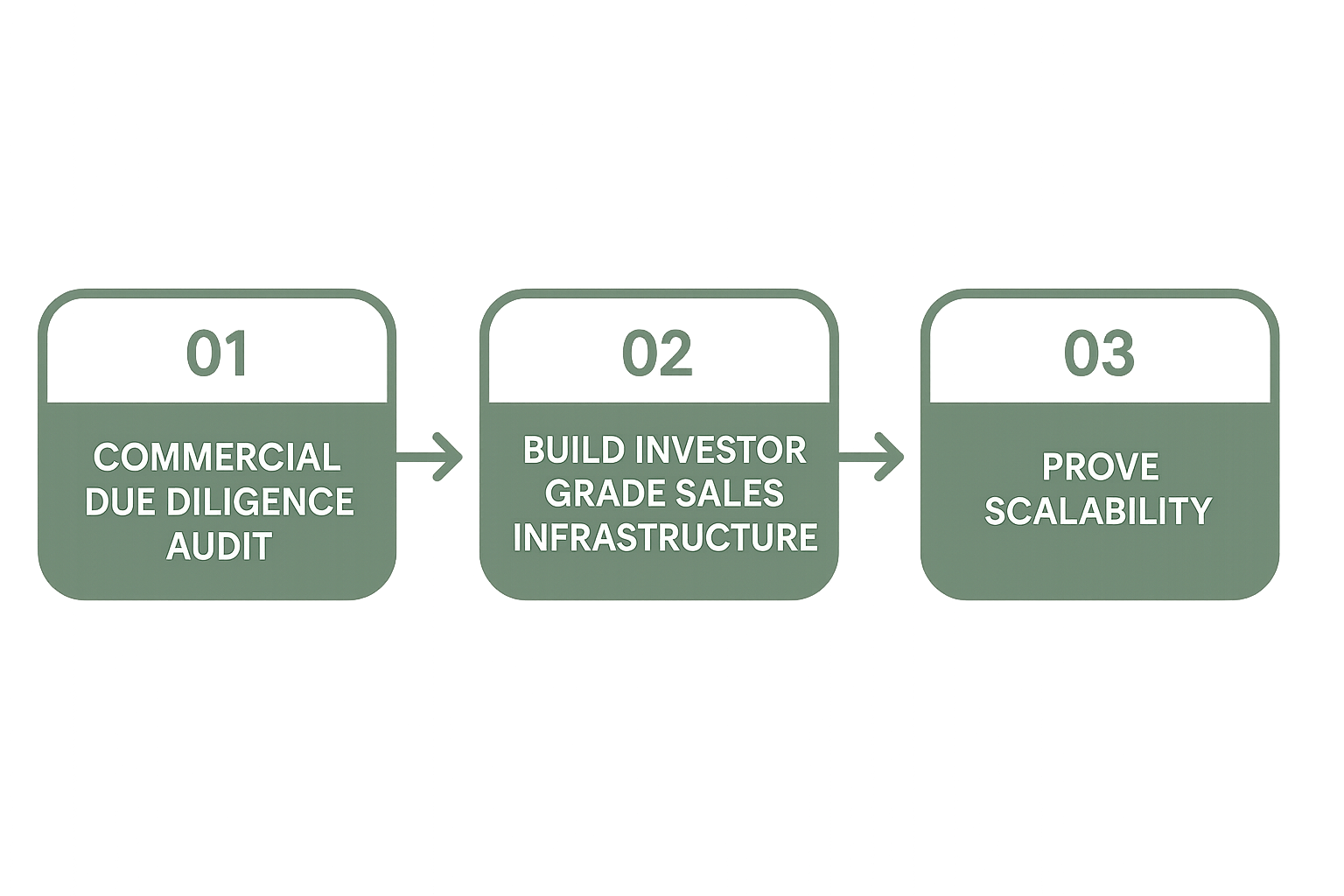

How Dunrod Prepares You For Due Diligence

Phase 1: Commercial DD Audit

We assess your business through an investor's lens - the red flags and green flags above. This means there are no surprises in due diligence. You know what needs fixing and how to fix it.

Phase 2: Build Investor Grade Infrastructure

We put all the green flags in place using the core Dunrod's sales optimisation framework. You can find out more here https://dunrod.com/salesforbusiness-leaders

Investors will perceive your sales function like it belongs in a £50M company, even if you're £5M today.

Phase 3: Prove Scalability

We ensure the business can grow without you - transfer your knowledge from leadership and founders to the team, and build systems that run without constant founder involvement. We help prove new hires can succeed by following your sales processes - new owners can invest in your business with confidence.

You are now selling a growth engine, not a giving the buyer the burden of creating a reliable sales environment.

The Valuation Impact

Research consensus shows implementing Sales as a Science principles increases valuation multiples by 48%. It's more a case of how quickly your move to implement these disciplines, not if.

Find Out More

If you want to know what thorough due diligence from investors or buyers looks like, click here https://www.dunrod.com/due-diligence

It's never too early to get your business ready for investment or sale. Your business performance will increase even if you don't pursue the investment or sale, so it's a win anyway. Get in touch today to arrange an initial consultation.